Real-Time Payments File

How to Import Real-Time Payments Request for Payment File to Bank, Credit Union, Financial Institution

Real-Time Payments File – ISO 20022 RfPs via FedNow® and RTP®

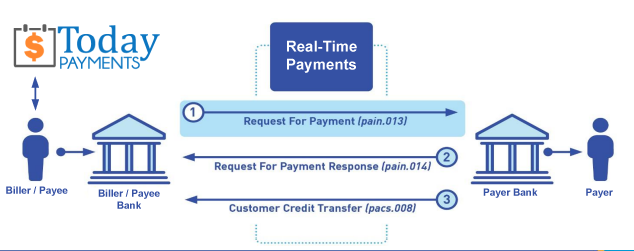

Real-Time Payments File enables U.S. businesses and payees to process all transactions through Request for Payments (RfPs) using real-time payment rails like FedNow® and RTP®. Using standardized ISO 20022 messaging in XML or HTML file formats, organizations can import, upload, and download real-time payment instructions through secure financial dashboards connected to U.S. banks and credit unions.

This format ensures faster settlement, more reliable tracking, and full automation of accounts receivable—without the need for paper invoices or delayed ACH transfers.

RfP File Formats Built for Real-Time Cash Flow

In today's 24/7 digital payment environment, speed, structure, and compliance are essential. Real-Time Payments File lets payees take control of their cash flow by uploading ISO 20022-compliant RfPs in structured XML or HTML formats. Each file includes payment instructions, alias-based identifiers, hosted payment links, and MID assignment to enable real-time transaction fulfillment across multiple financial institutions.

These files are uploaded and downloaded through intuitive payee dashboards—making it easy to issue, track, and reconcile payments from anywhere.

Core Features of Real-Time Payments File Processing

ISO 20022 Messaging Format (XML and

HTML)

Each Real-Time Payments File is structured

using ISO 20022 in XML or .html, allowing seamless communication

with all banks and credit unions that support FedNow® and RTP®.

FedNow® and RTP® Compatibility for RfPs

Once imported or uploaded, each file triggers a Request for

Payment that is routed in real time through the best available

network, ensuring 24/7 transaction speed and reliability.

Alias-Based MID Assignment and

Management

Merchant Identification Numbers

(MIDs) can be linked to mobile numbers or email addresses,

allowing personalized payment tracking for each customer,

location, or business unit.

Hosted Payment Links in Every RfP File

Each transaction includes a hosted payment page embedded

within the file. Customers can respond to the request with one

click via web, email, or SMS.

Import, Upload, and Download via Secure

Dashboards

Payees gain full control over batch

uploads, downloadable payment confirmations, audit logs, and

reconciliation exports—all from a unified dashboard.

Nationwide Bank Compatibility and

Multi-Entity Support

The platform supports file

processing across all 50 states, all financial institutions, and

any business structure—whether Schedule C, LLC, S-Corp, or

Enterprise.

Why Payees Use TodayPayments.com for Real-Time Payments Files

1. Upload ISO 20022 XML and HTML files

that trigger FedNow® and RTP® RfPs

2. Import and

download payment status files from a secure online dashboard

3. Use alias-based MIDs to track and reconcile payments in real

time

4. Embed hosted payment links into every

transaction record

5. Eliminate paper invoices, reduce

AR aging, and accelerate cash flow

6. Reconcile directly

into QuickBooks® Online or other ERP systems

7. Fully

digital setup—no bank visits or in-person paperwork required

Importing a Real-Time Payments (RTP) Request for Payment (RfP) file to a bank, credit union, or financial institution involves several key steps and considerations to ensure the process is secure, compliant with regulations, and efficient.

Here’s an outline of how you might go about this process:

Steps for Importing RTP Request for Payment File:

- File Format and Structure:

- RTP RfP files typically follow the ISO 20022 XML format, which is the international standard for electronic data interchange between financial institutions.

- Confirm the specific format required by the bank, credit union, or financial institution, which may differ slightly in structure or required fields based on their payment system configurations.

- Access to the Bank’s RTP System:

- Ensure that the institution has RTP capabilities integrated with The Clearing House or a similar RTP network.

- The financial institution must provide access to its RTP gateway or API. This could be a web portal, a secure file transfer protocol (SFTP) server, or direct API access for programmatic uploads.

- Authentication and Security:

- Establish secure authentication protocols, such as OAuth, mutual TLS (mTLS), or other forms of cryptographic authentication.

- Make sure that the RfP files are encrypted during transit, typically using Secure File Transfer Protocol (SFTP) or API encryption standards like HTTPS or AES.

- Implement security controls such as tokenization or digital signatures to ensure the integrity of the RfP data.

- Data Validation:

- Validate that the RTP RfP file adheres to the bank’s schema, such as correct formats for dates, currencies, payer/payee details, and transaction identifiers.

- Run compliance checks to ensure the RfP file meets legal requirements (e.g., KYC, AML) for the financial institution and RTP network.

- Some institutions may require the files to undergo further validation before processing, such as fraud checks or additional approval workflows.

- File Import Process:

- SFTP Transfer:

- If using SFTP, you would need to place the file into the designated folder provided by the bank or credit union.

- The institution will likely have a monitoring system in place to detect new RfP files and process them automatically.

- API Upload:

- If the institution provides API access, you would typically send the RTP RfP file as part of an HTTP POST request, along with authentication tokens and any other required headers.

- Batch Uploads:

- Some institutions may allow for batch processing of multiple RfP files, which involves uploading a compressed or consolidated file containing multiple requests.

- SFTP Transfer:

- Confirmation and Acknowledgement:

- Once the file is imported successfully, the institution should send an acknowledgment, confirming receipt and validation of the RfP.

- RTP systems often provide status updates, such as "Received," "Accepted," or "Rejected." These updates can be accessed via the institution’s portal or API.

- Reconciliation and Tracking:

- Reconciliation involves tracking the status of each RfP through its lifecycle, from the initial submission to payment completion.

- Ensure the financial institution provides detailed reporting tools or API endpoints to track the success or failure of requests.

- Error Handling and Retries:

- Have systems in place for error handling in case an RfP file is rejected due to validation failures or format issues. Errors will typically come with response codes that can be interpreted to resolve issues.

- Implement automatic retries for transient errors, like network timeouts or server unavailability.

Best Practices:

- Compliance with Standards: Ensure that your system complies with all ISO 20022 standards and RTP network rules for creating and importing RfP files.

- Automation: If possible, automate the process using APIs to avoid manual file uploads and minimize errors.

- Monitoring and Alerts: Set up real-time monitoring and alerting systems to be notified of any issues during the import process, such as failures or validation errors.

- Testing Environment: Most banks and financial institutions provide a sandbox or testing environment where you can test the import of RfP files before going live.

By following these steps and best practices, you can streamline the process of importing RTP Request for Payment files into a bank, credit union, or financial institution.

Upload, Track, and Reconcile in Real Time at TodayPayments.com

Are you still managing outdated ACH files or waiting on checks?

✅ Upload real-time RfPs using ISO

20022 XML or .html

✅ Trigger instant payments via

FedNow® and RTP®

✅ Assign and manage alias-based MIDs

for each customer

✅ Access hosted payment links and

downloadable reconciliation files

✅ Eliminate delays,

batch lags, and paperwork

✅ Set up online, go live

instantly—no bank branch needed

Start processing Real-Time Payments Files now

at

https://www.TodayPayments.com

Real-Time Payments File –

Structured for Compliance, Built for Speed.

Creation Request for Payment Bank File

Call us, the .csv and or .xml Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

... easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

1) Free ISO 20022 Request for Payment File Formats, for FedNow and Real-Time Payments (The Clearing House) .pdf for you manually create "Mandatory" (Mandatory data for completed file) fields, start at page 4, with "yellow" highlighting. $0.0 + No Support

2) We create .csv or .xml formatting using your Bank or Credit Union. Create Multiple Templates. Payer/Customer Routing Transit and Deposit Account Number may be required to import with your bank. You can upload or "key data" into our software for File Creation of "Mandatory" general file.

Fees = $57 monthly, including Support Fees and Batch Fee, Monthly Fee, User Fee, Additional Payment Method on "Hosted Payment Page" (Request for file with an HTML link per transaction to "Hosted Payment Page" with ancillary payment methods of FedNow, RTP, ACH, Cards and many more!) + $.03 per Transaction + 1% percentage on gross dollar file,

3) Payer Routing Transit and Deposit Account Number is NOT required to import with your bank. We add your URI for each separate Payer transaction.

Fees Above 2) plus $29 monthly additional QuickBooks Online "QBO" formatting, and "Hosted Payment Page" and WYSIWYG

4) Above 3) plus Create "Total" (over 600 Mandatory, Conditional & Optional fields of all ISO 20022 Pain .013) Price on quote.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Activation Dynamic RfP Aging and Bank Reconciliation worksheets - only $49 annually

1. Worksheet Automatically Aging for Requests for Payments and Explanations

- Worksheet to determine "Reasons and Rejects Coding" readying for re-sent Payers.

- Use our solution yourself. Stop paying accountant's over $50 an hour. So EASY to USE.

- No "Color Cells to Match Transactions" (You're currently doing this. You won't coloring with our solution).

- One-Sheet for Aging Request for Payments

(Merge, Match and Clear over 100,000 transactions in less than 5 minutes!)

- Batch deposits displaying Bank Statements are not used anymore. Real-time Payments are displayed "by transaction".

- Make sure your Bank displaying "Daily FedNow and Real-time Payments" reporting for "Funds Sent and Received". (These banks have Great Reporting.)

Contact Us for Request For Payment payment processing